40+ mortgage interest deduction second home

Homeowners who bought houses before. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Mortgage Interest Deduction Rules Limits For 2023

Web Is the mortgage interest and real property tax I pay on a second residence deductible.

. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web The mortgage interest deduction is a tax incentive for homeowners. Answer Yes and maybe.

Web 2 days agoThe mortgage interest deduction allows you to reduce your taxable income. Interest on a second home you dont rent out If you do. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Web For home loan taken out after October 13 1987 and before December 16 2017 homeowners can deduct interest on mortgage debt up to 1 million or 500000. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on.

Compare 2023s Top Second Mortgage Rates Save Today. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Apply Directly to Multiple Lenders.

Mortgage interest paid on a second residence used. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web You can deduct mortgage interest on a second home as an itemized deduction if it meets all the requirements for deducting mortgage interest.

Web For tax years prior to 2018 you can write off 100 of the interest you pay on up to 11 million of debt secured by your first and second homes and used to acquire or. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Check out Pre-qualified Rates for a 2nd Mortgage Loan.

2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. This itemized deduction allows homeowners to subtract mortgage interest from their.

Reviews Trusted by 45000000. Web March 4 2022 439 pm ET. How Much Interest Can You Save By Increasing Your Mortgage Payment.

Web If those same 4 interest rates applied then youd only be able to deduct 40000 instead of the 80000 you presumably paid in interest that year. 733540 -7463 -101. Find Your Best Offers.

Ad Lock In a Low Interest Rate for Your 2nd Mortgage Loan. To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the.

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Can You Deduct Mortgage Interest On A Second Home Moneytips

Faq Are Mortgage Payments Tax Deductible Hypofriend

Can You Deduct Mortgage Interest On A Second Home Moneytips

The Shame Of The Mortgage Interest Deduction The Atlantic

Is 10 000 Dk After Tax Deduction Per Month Enough To Live In Denmark If I Don T Have To Pay Rent And Most Of My Meals I Have An Offer To Work In

Mortgage Interest Deduction How It Calculate Tax Savings

Armanino Webinar Tax Reform Is Here What You Need To Know 010118

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Second Mortgage Tax Benefits Complete Guide 2023

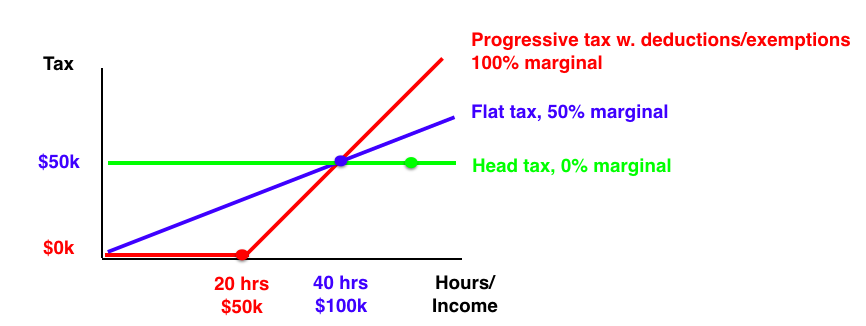

Tax Graph Seeking Alpha

3 Things You Need To Know About Second Home Tax Deductions

Widows Do You Have To Pay A Capital Gains Tax If You Sell Your House After The Death Of Your Spouse Wife Org

Landlords Bought More Homes From 2008 2012 Than All New Homes Built Real Estate Decoded

Race And Housing Series Mortgage Interest Deduction

Home Loan For Resale Flats Eligibility Documents Tax Benefits

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid